Transform Your Accounts Payable

Professional AP management services that help you pay bills strategically, improve cash positioning, and unlock hidden working capital.

Optimize Cash Flow While Building Stronger Vendor Relationships

Strategic Bill Payment

Improved Cash Positioning

Gain better control over your finances by enhancing cash visibility and liquidity.

Unlock Working Capital

Why Strategic Accounts Payable Management Matters

Improved Cash Flow

Timing payments strategically allows you to hold onto your cash longer, improving your working capital position and providing flexibility for unexpected expenses or opportunities.

Stronger Vendor Relations

Consistent, reliable payment practices build trust with suppliers, potentially leading to better terms, priority service, and mutually beneficial partnerships.

Financial Control

Regular reconciliation prevents errors, duplicate payments, and fraud while providing accurate financial reporting for better decision-making.

Our Monthly Accounts Payable Reconciliation Process

Vendor Statement Collection

We gather all vendor statements and compare them against your internal records to identify any discrepancies in amounts, payments, or outstanding balances.

Detailed Analysis

Our team performs thorough reviews of payment histories, credit memos, and outstanding invoices to ensure complete accuracy in your payables.

Reconciliation Report

We provide a comprehensive report highlighting discrepancies, recommended actions, and optimal payment timing to maximize your cash position.

Strategic Payment Planning

Based on due dates, cash availability, and vendor relationships, we create a payment schedule that optimizes your working capital while maintaining vendor goodwill.

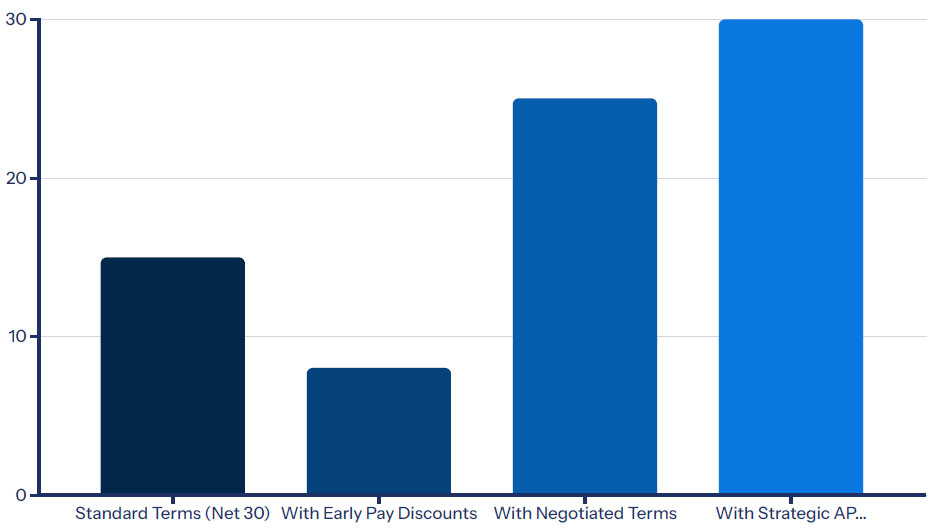

The Cash Flow Advantage

Common AP Challenges We Solve

Visibility Issues

Many businesses struggle with limited visibility into their outstanding payables, making it difficult to plan cash flow effectively. Our monthly reconciliation creates a clear picture of your payment obligations and opportunities.

Error Detection

Payment Timing

Resource Constraints

The Real Cost of Poor AP Management

3.6%

Annual Revenue

$12.44

Per Invoice

62%

Of Businesses

45

Days

Our Comprehensive Accounts Payable Services

Monthly Vendor Reconciliation

We compare your records with vendor statements to identify and resolve any discrepancies, ensuring accuracy in your financial obligations.

Payment Optimization

We analyze due dates, cash availability, and vendor terms to create a payment schedule that maximizes your working capital without damaging supplier relationships.

Vendor Communication

We professionally handle vendor inquiries about payment status, resolve disputes, and maintain positive relationships with your suppliers.

AP Reporting

Receive detailed reports on aging payables, cash flow projections, and potential early payment discount opportunities to improve financial planning.

Is Your Current AP Process Costing You Money?

Do you reconcile vendor statements against your AP ledger at least monthly?

Without regular reconciliation, discrepancies can go unnoticed for months, leading to cash flow surprises and damaged vendor relationships.

Are you timing payments strategically or simply paying bills as they arrive?

Do you have visibility into upcoming payment obligations for the next 30, 60, and 90 days?

Are you capturing all available early payment discounts when cash flow allows?

Ready to Optimize Your Accounts Payable Process?

Schedule Your Free Consultation

During your consultation, we’ll discuss your current AP challenges, identify potential areas for improvement, and outline a customized solution for your business.

Contact us at +1 772 362 4415 or info@accountingbeez.com to learn more about how our accounts payable services can benefit your business.